Year in Review

Over Christmas, I took some time off. It was a necessary break. My wife also runs a business, and we’ve not taken time off since March 2020.

During the time off certain things became clearer. I read a quote (from slightly whacky East-meets-West philosopher, Alan Watts) that stuck, “You are under no obligation to be the same person you were five minutes ago.” Reflecting on 2024, I’m more convinced (confirmation bias perhaps?) that continual learning, constant evolution, and generalism are necessary if we’re to adapt, avoid harm, and enable sensible risk-taking.

The 2024 sample I used to arrive at those conclusions and the following observations: 25 projects, spanning 67 countries (in order: Africa, Europe, Asia, LatAm), covering a broad array of sectors (in order: investment, energy, healthcare, manufacturing, agribusiness, NGO, and government).

1. ESG – The Resurrection

ESG in its current form (too much box-ticking) is contentious, and it only has itself to blame. The good news, sensible and sanguine analysis (e.g., Transparency International’s Investing With Integrity II) is helping highlight the overlap between environment, social, and governance topics. In every investment project, my work (usually termed “business integrity; BI”) overlaps considerably with E&S.

Poor E&S creates BI risks. From land clearance, and labour relations, to emissions, when it goes wrong, the BI risks go through the roof. E&S controls without BI considerations create overlap, redundancy, and confusion. For instance, creating a local community grievance mechanism (a standard “S” requirement, and often just an email or a physical box on site that might be checked weekly) without considering how internal stakeholders should raise concerns will lead to confusion and eventually, chaos. In this context, we (E, S, and G people) must work together to understand overlapping risks, and the consequences of (in)actions, and coordinate the cultural and control pieces.

Action on our part: We’re currently in the final stages of developing a BI toolkit to help investors (it would also work in M&A or appointing key third parties) in collaboration with TI Sweden and Swedfund (more soon).

2. Start Somewhere

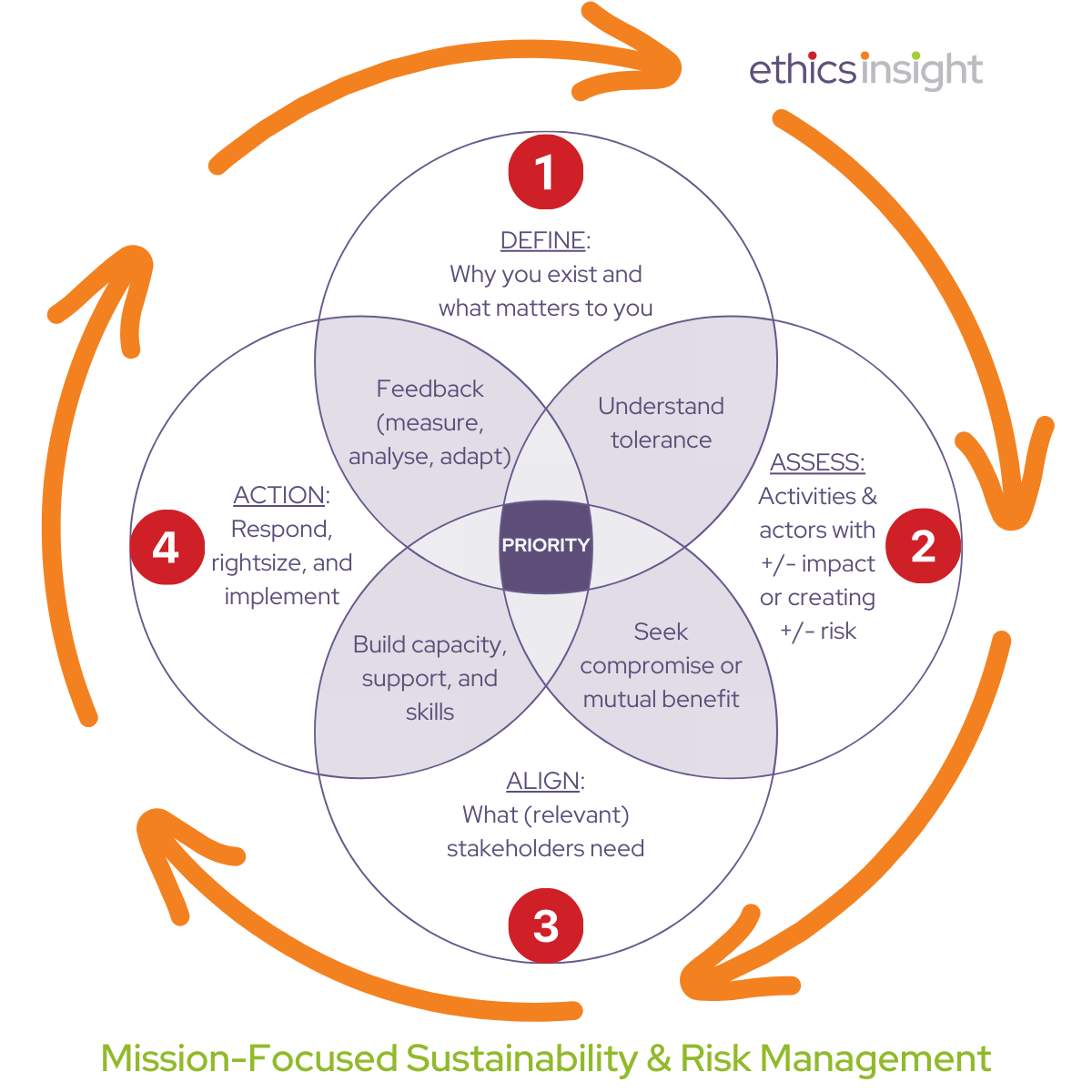

When working with SMEs and mid-caps, they don’t have unending resources and time is even scarcer. Implementing rightsized risk frameworks became an even larger part of Ethics Insight’s business in 2024. Many of the mid-caps and SMEs we help have some sort of framework in place. Often that looks like this: a smart management team micromanaging every decision to de-risk the business while struggling to implement clunky policies from boilerplate law firms. Our task is to start where it matters most – where they have most to lose (or gain). Next, we need to focus on knowledge transfer – coupling guidance with tools/content. For instance, handing over a boilerplate anti-bribery policy is not very helpful if it doesn’t explain which bits should be adapted to the organization’s risk tolerance and operating context, and, crucially, how to do that (examples, pros and cons, etc.).

Action on our part: Build out the ~200 guides, policies, training kits, assessments, and tracking tools to ~250 by the end of 2025. Make these tools accessible via a language learning model (AI tool) we’re training to answer risk questions and direct the user to potential solutions (which they can purchase online).

3. Getting the Right People for the Task

Having recently inherited a tragically badly managed harassment case led by an auditor who was way out of their comfort zone (not their fault; the issue was made their problem), we can’t keep doing this. Well, we can. But the cost will be employee trust, which is already at historic lows. A lifeguard on Bondi Beach and an expert neurosurgeon are both in the business of saving lives. But I’d prefer they didn’t switch roles. Investigators should not be doing gonzo auditing, HR reviews, or month-end accounts, so why the hell are auditors, HR, and finance routinely allowed to botch investigations? I would apologise for the tone, but it’s not sincere. When we’re dealing with people’s welfare (whistleblowers, witnesses, and victims all suffer all too often), get a professional.

Action on our part: I’m working (on the advisory panel) of the Association of Corporate Investigators on exactly what this should look like. A report/paper will come out later this year, stay tuned.

What are your 2024 observations, and how will they change your approach to 2025?